Fascination About chapter 13 bankruptcy

Although the repayment approach itself is usually sophisticated underneath Chapter thirteen. It must deal with 3 differing types of creditors: precedence, secured and unsecured.

Homeowners who will be owning difficulties building mortgage loan payments and/or have fallen driving on their own payments might have solutions that could permit them to prevent foreclosure and bankruptcy.

Unsecured debts are those that have no collateral, for instance charge card financial debt. They can be compensated very last and might not be paid out in complete—or in the least. The bankruptcy courtroom will look at the debtor’s disposable cash flow in selecting simply how much income unsecured creditors must get.

With the paperwork and counseling done, you’re able to file. The filing fee is $310, but If you're able to’t afford it, it is possible to file a petition to have it waived.

Martindale-Hubbell® Peer Overview Rankings™ will be the gold conventional in attorney ratings, and are already for in excess of a century. These ratings point out attorneys who're broadly revered by their friends for his or her moral standards and legal experience in a certain place of practice.

Acquire our bankruptcy quiz to identify opportunity problems and find out how to most effective continue along with your bankruptcy situation.

Chapter thirteen puts a hard-pressed debtor with a repayment approach and features several types of aid. To start with, a freeze on collections starts off as soon as the bankruptcy petition is filed.

Other Positive aspects that aren't obtainable in Chapter seven include things like getting this link rid of junior mortgages over a home using "lien stripping" and paying out significantly less on a car or truck mortgage by using a "cramdown."

A Chapter 13 bankruptcy commonly stays in your credit history reviews for 7 many years from the date you submitted the Recommended Site petition. It may lower your credit history rating by around one hundred thirty to 200 factors, but the consequences with your credit diminish after some time. As you fix your credit history, it might be tough to qualify for new loans or other sorts of credit score. There’s also force to keep up with the 3- to 5-year strategy because missing payments could lead to some dismissal. In that case, you stand to get rid of any property you were being striving to protect. Because of this, Chapter 13 bankruptcy must be utilised as a last resort. How you can file for Chapter thirteen

Are you able to rent an condominium in next the course of a Chapter thirteen repayment strategy? Of course. Most landlords will execute a credit Check out during your rental software.

Improved Credit score Score: Although bankruptcy should have a destructive influence on your credit score score, Additionally, it provides a possibility for the clean economic start. By eliminating your too much to handle credit card debt, you'll be able to start off rebuilding your credit rating and working towards a much healthier economic long term.

Stick to the explanation repayment prepare about three to five years. Your trustee will collect and distribute payments in the course of this time. When you finally’re carried out with repayment, the bankruptcy situation will probably be discharged.

Established in 1976, Bankrate has a long reputation of helping individuals make wise economical alternatives. We’ve preserved this standing for over four many Our site years by demystifying the monetary selection-creating course of action and giving folks confidence through which steps to take following. Bankrate follows a demanding editorial plan, so you can trust that we’re putting your interests initial.

Although specific assets may very well be marketed, persons can usually keep essential possessions and assets safeguarded beneath Virginia’s bankruptcy exemptions. By Profiting from the

Mara Wilson Then & Now!

Mara Wilson Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Mike Vitar Then & Now!

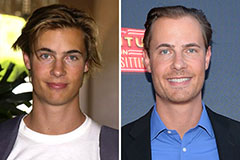

Mike Vitar Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!